UK translation services are critical for non-native English speakers engaging in international financial transactions, especially for accurate translations of loan agreements and credit reports. These specialized services ensure that all financial terms, figures, and legal stipulations are precisely conveyed into the target language, maintaining the original document's meaning and compliance with legal standards. The importance of certified translations in this context cannot be overstated, as they enable financial institutions to accurately assess creditworthiness and terms, including repayment schedules, interest rates, and other critical details, without ambiguity. This level of precision is essential to prevent misinterpretation and potential financial harm, and it is a necessary step for facilitating secure and transparent financial dealings within the UK or internationally. Professional translation services in the UK offer deep linguistic and financial expertise to provide trusted, precise translations that are essential for building trust among all parties involved in cross-border financial operations. These services adhere to international quality standards and ensure that loan agreements and credit reports are accurately translated and certified, which is often a mandatory requirement for financial documents within the UK's jurisdictional framework.

When financial stakes are high, precision in documentation is paramount. This article delves into the critical role of certified translations for credit reports and loan documents within the UK’s dynamic financial landscape. It outlines the necessity for professional UK translation services to navigate the complexities inherent in these sensitive records, ensuring they convey exact meanings across languages. We will explore the intricacies involved in selecting a reliable service provider, the meticulous process of translation that guarantees accuracy and compliance, and the common challenges translators face. A case study illustrates how flawless translation of loan agreements and credit reports can pave the way for seamless international financial operations. Join us as we shed light on this integral aspect of cross-border finance.

- Understanding the Necessity for Certified Translations in Financial Documentation

- The Role of Professional Translation Services in Credit Report and Loan Agreement Contexts

- Key Considerations for Choosing a Reliable UK Translation Service for Financial Documents

- The Translation Process: Ensuring Accuracy and Compliance in Credit Reports and Loan Agreements

- Common Challenges and Solutions in Translating Credit Reports and Loan Documents

- Case Study: Successful Certified Translation of Loan Agreements and Credit Reports Facilitating International Finance Operations

Understanding the Necessity for Certified Translations in Financial Documentation

When individuals or businesses seek to engage with financial institutions in countries where the official language differs from their own, the accurate and certified translation of loan agreements and credit reports becomes a critical aspect of the transaction. In the UK, for instance, where transactions often involve English credit reports and loan agreements drafted in English, non-native speakers must navigate these documents with precision. This is where specialized UK translation services play an indispensable role. These services ensure that every term and figure within these financial instruments is accurately rendered into the target language, maintaining the integrity of the original content and the legal compliance of the translated document. The necessity for certified translations arises from the fact that financial institutions require exact translations to assess creditworthiness, terms of repayment, interest rates, and other crucial details without ambiguity. This is not merely a formality but a safeguard against misinterpretation or error, which could have significant financial implications. Therefore, when engaging in international financial dealings, reliance on professional UK translation services for loan agreements and credit reports is both prudent and mandatory to ensure that all parties have a clear and mutually understandable agreement. This level of accuracy and trustworthiness is encapsulated in certified translations, which come with a statement of accuracy and a translator’s signature or stamp, thereby confirming the document’s reliability for use by financial institutions within the UK or abroad.

The Role of Professional Translation Services in Credit Report and Loan Agreement Contexts

When individuals or businesses seek to operate across linguistic borders within the UK, accurate translations of credit reports and loan agreements become paramount. The precision of these documents directly impacts financial transactions and credibility. In such contexts, professional translation services play a pivotal role in ensuring that the nuances and legalities contained within these critical financial documents are conveyed accurately. These experts are well-versed in both the linguistic intricacies and the financial jargon inherent to loan agreements and credit reports, which are often complex and require a deep understanding of context. By providing certified translations, these services guarantee that the translated content aligns with the original text, adheres to legal standards, and maintains the integrity of the financial information. This is crucial for maintaining trust among stakeholders, including lenders, credit bureaus, and regulatory bodies. In the UK, where legislation varies by jurisdiction, the importance of professional translation services cannot be overstated, as they ensure that all parties have a clear and precise understanding of the terms and conditions outlined in these essential financial documents. Engaging such services not only mitigates the risk of miscommunication but also facilitates seamless transactions across different linguistic communities within the UK’s diverse marketplace.

Key Considerations for Choosing a Reliable UK Translation Service for Financial Documents

When engaging with a UK translation service for financial documents such as loan agreements and credit reports, it is imperative to prioritize accuracy and reliability given the sensitive nature of these records. The translated content must reflect the exact nuances of the original text, as any discrepancies can lead to significant misunderstandings or even financial repercussions for the individuals involved. A seasoned translation service specializing in legal and financial documents will possess native-speaking translators with expertise in banking terminology and the legal context surrounding credit reports and loan agreements in the UK. These professionals are adept at navigating the complexities of financial language, ensuring that every term, figure, and condition is conveyed precisely as it appears in the source document. Additionally, a reputable service will offer certification for translations, which is often required by financial institutions and regulatory bodies. This certification confirms the authenticity and legal standing of the translated documents, facilitating seamless processing and compliance with UK regulations. It is advisable to seek out translation services that have a proven track record in this niche, demonstrate adherence to industry standards such as ISO 17100, and provide robust customer support to address any queries or concerns during the translation process. By carefully vetting potential service providers against these criteria, you can select a partner that will deliver translations of credit reports and loan agreements with the highest degree of precision and professionalism.

The Translation Process: Ensuring Accuracy and Compliance in Credit Reports and Loan Agreements

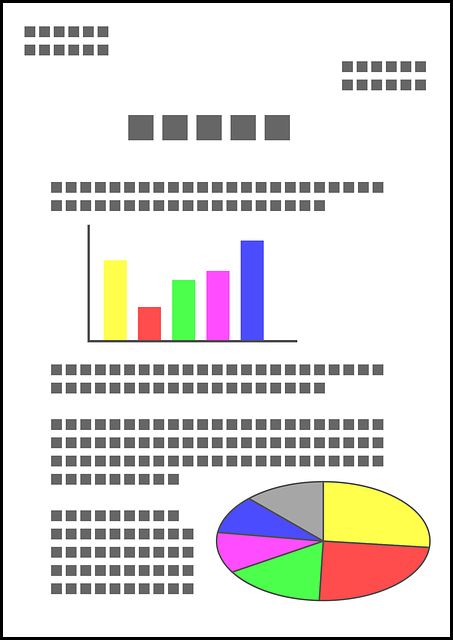

When it comes to cross-border financial transactions, the precision of credit reports and loan agreements is paramount. In the UK, where a multicultural landscape is the norm, certified translations of these documents are crucial for individuals and institutions operating across language barriers. The translation process for such critical financial documents involves not only converting the text from one language to another but also ensuring that the semantic context is accurately captured. This is where specialized UK translation services excel. They employ expert linguists who are adept at understanding the nuances of credit reporting and loan agreements, translating them with a keen eye on compliance with both UK law and the regulations governing financial documentation in the target language. These professionals work diligently to maintain the integrity and clarity of the original content, ensuring that all numerical data, terms, and conditions are accurately represented. This meticulous approach is essential for maintaining trust between parties and for the validity of transactions. By leveraging advanced translation technology and human expertise, these services deliver translations that meet legal standards and facilitate secure financial dealings across different linguistic regions.

Common Challenges and Solutions in Translating Credit Reports and Loan Documents

Navigating the nuances of loan agreements and credit reports in a multilingual context presents unique challenges that require specialized attention. In the UK, where financial terminology can be both precise and legally sensitive, translation services must possess not only linguistic expertise but also an intimate understanding of the financial sector’s regulations and standards. A common hurdle is the accurate conveyance of credit history, which involves translating a detailed narrative of an individual’s borrowing patterns, payment histories, and creditworthiness. Certified translation services in the UK play a pivotal role here, ensuring that the translated documents maintain the integrity and clarity of the original text. They employ skilled translators who are adept at handling complex financial terminology and legal jargon inherent in loan agreements and credit reports. These professionals undergo rigorous training to guarantee their translations adhere to both the source and target language’s legal frameworks, ensuring that all numerical data, financial terms, and conditions are accurately represented. Solutions to these challenges often hinge on the use of advanced translation software combined with human expertise, a process known as ‘human-assisted machine translation.’ This approach leverages the speed and efficiency of machines to handle large volumes of text while relying on human translators to refine nuances and context-specific details that automated systems may overlook. By doing so, UK translation services can provide clients with precise, reliable, and legally compliant translations of their credit reports and loan documents, facilitating seamless international transactions and peace of mind for all parties involved.

Case Study: Successful Certified Translation of Loan Agreements and Credit Reports Facilitating International Finance Operations

In an increasingly globalized financial marketplace, the accuracy and reliability of loan agreements and credit reports translated across different languages are paramount for successful international finance operations. A recent case study exemplifies this necessity through the successful deployment of UK translation services specializing in Certified Translations. The case involved a multinational corporation seeking to expand its operations into a new market. To facilitate the acquisition of local assets, the company required a comprehensive understanding of the target entity’s financial standing. This entailed the precise translation of its credit reports and loan agreements from English to the local language, ensuring that all fiscal obligations and terms were accurately conveyed. The UK translation services provider leveraged its expertise in certified translations to deliver translations that were not only linguistically sound but also legally compliant with international standards. This meticulous approach enabled the corporation to make informed decisions, secure financing, and navigate cross-border transactions with confidence.

The importance of such high-quality translations cannot be overstated, as they serve as the foundation for financial institutions and businesses engaging in international trade. The certified translations provided by the UK translation services allowed all parties involved to have a clear and unambiguous understanding of the financial commitments and conditions stipulated within the loan agreements and credit reports. This level of precision is crucial when dealing with complex financial instruments, as errors or misinterpretations could lead to significant legal and financial repercussions. The successful translation facilitated due diligence, risk assessment, and the establishment of transparent relationships between the entities, ultimately contributing to the seamless integration of the corporation’s new market venture.

When navigating the complexities of international finance, the precision of loan agreements and credit reports hinges on accurate translation. The necessity for certified translations, as detailed in this article, underscores the critical role UK translation services play in this domain. By leveraging the expertise of professional translation services specializing in financial documentation, individuals and businesses can ensure that their credit reports and loan documents are accurately conveyed, maintaining compliance and clarity across borders. The intricate process of translation, as explored herein, involves meticulous attention to detail and a deep understanding of both source and target languages. It is through these rigorous measures that challenges in translating financial texts are effectively addressed, ensuring that loan agreements and credit reports accurately reflect their original intent. This article has highlighted the indispensable nature of UK translation services in this context, safeguarding the integrity and function of financial documentation for a global audience.